As upgrades on the proceedings with as they do not own an advance, a fantastic a lot of folks do not expect to get affected by it, Problems from the mortgage economies spreads. Business debtors especially might be considering how problems from the private markets can impact them, How could somebody be able to else’s horrible home improvement effect my organization. Everybody knows this bit of this narrative now. All throughout the burst, some loan pros pulled into the table with reduced prices borrowers. The loan pros at the point gathered them and offered them as protections at the markets. A liquidity media is where the borrowers that are poisonous are eliminated of this marketplace. There are two ways this may take – good and awful – with levels of distress for everyone.

As those rates’ instances Completed, the continuing increments in prices for example, the Federal Reserve raised its key rate for 17 straight quarters from 2004 to June 2006 – from 1 percent to 5.25% drive their residence installments beyond their capability to pay. Albeit a lot of those debtors had the choice to re-money with fixed-rate contracts, also many were not really that blessed. Combined having an easing back accommodation marketplace, these home holders ended up stuck at a house loan which they were not able to afford and assess about Prime Loans. It has prompted the crisis we are on the finding around. Overall, what exactly does that have to do with the re-financing of my supply centre or the entire lease in my furnace, asks the company person. After some time, the cash related markets have become globalized -.

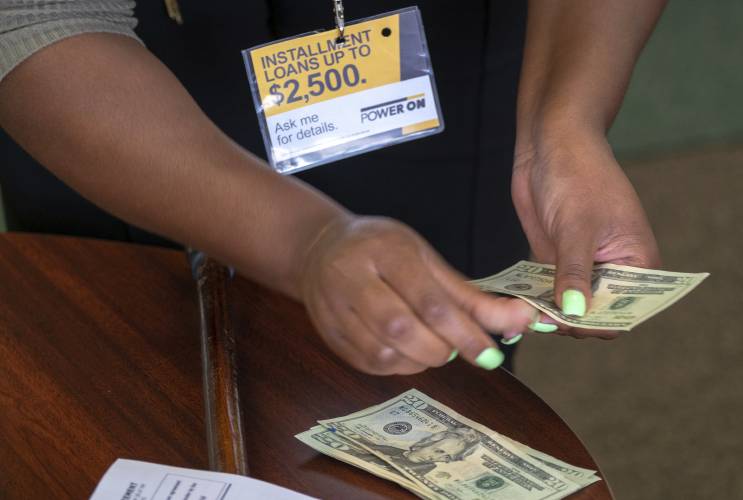

A lot of similar financial experts who bought those sub-prime mortgage protections buy protections in company credits or place funds into private banks or worth companies. Currently, these subsidizing resources are becoming touchy and are considering whether they ought to clutch a larger amount of the money – only in case that something different will happen and check for licensed moneylender bras basah. Similarly, as the sub-prime protections exceeded their typical levels of default and fiscal experts quit buying new protections, moneylenders were abandoned billions of dollars of securitized contracts in their books and could not turn them to recharge their resources for new credits – personal or company. That suggests a decrease in flexibly and entrepreneurs understand, that prompts costs that are expanded. Similarly, similarly as with numerous business sectors, there is in some circumstances an automated reaction to increase costs since everyone realizes you increase costs in this kind of circumstance. That is currently causing what small business analysts that are many are currently alluding to smash.